Your car insurance policy has a declaration page that declares what coverages and limits you’ve chosen to buy to protect yourself in case of an accident. Sometimes, an agent will refer to this page as the Dec Page. This page also explains how much you have to pay before your coverage kicks in (the deductible). It’s always best if you can depend on a personable and knowledgeable agent to go over this page with you.

Typically, your auto insurance company will send you a policy declaration every time you renew your car insurance policy. While declarations look different from company to company, they all have the same essential bits of information about your coverage. The Insurance Specialists at AIS work with several carriers and their agents can help you if you call (888) 772-4247.

It’s very important to review your policy declarations page as soon as you get it to make sure that the binding terms of the agreement are what you elected. Check thoroughly to make sure all the information is correct.

Every declaration page on an auto policy has the following:

- Policy number

- Policy period

- Drivers listed / Drivers excluded

- Covered vehicles

- Non-factory equipment, if coverage is purchased.

- Loss payees

- Premium total

- Types of coverage

- Coverage or liability limits

- Deductibles

- Discounts

- Endorsements or Riders

Policy Number

You’ll usually find this number at the top of the page. Sometimes, it even precedes your name. This will be the same number you will also find on your insurance card that you should always have with you when you are driving. Providing this number is the most efficient way for an agent to pull up your account, so keep it handy.

Policy Period

Also known as the policy term, this is the amount of time for which coverage is provided. This time period is usually six months or a year, depending on your agreement. The policy period will also be found on the cards issued to you.

Drivers Listed

You’ll find this information at the top of the page, often as the very first item. Here, you’ll find your name and the names of everyone who lives with you, unless you’ve listed certain people as excluded drivers. You may also add people to this list if you know that you will be sharing your vehicle with others on a regular basis. The driving record and other characteristics of the people listed on your policy may affect your rate. New drivers have the highest rates due to their higher rate of accidents.

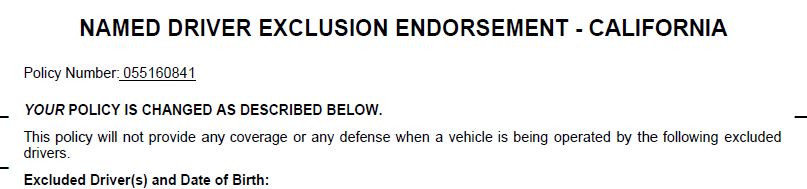

Drivers Excluded

Let’s say that you rent out the downstairs unit of your home and do not want your tenants’ names on your policy. You can exclude them and that exclusion will be found in the declaration policy. Now, let’s say you have a teen you know is raising your rate. You can exclude your child, but do keep in mind that if he or she does borrow the car and gets into an accident, you will not be covered because of the exclusion on your policy.

Covered Vehicles

On the declaration page, you will find the vehicles you are insuring along with the vehicle ID (VIN) or serial number.

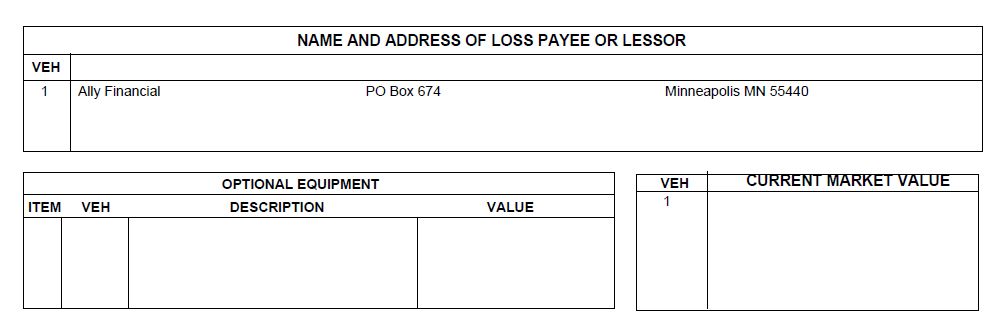

Loss Payees or Lienholders & Special Equipment

If there is a lienholder on the vehicle and you are still making payments, that lienholder must be on the declaration page. This information is very important and easy to miss so make sure that your lienholder is listed if there is one. If you are financing or leasing a car through Volkswagen, for instance, Volkswagen Credit will be the loss payee or lienholder. If you are leasing your vehicle, the leasing company may be listed as an Additional Insured in this section.

This is the area in which things like custom rims and other expensive accessories that can be stolen or damaged should be listed under Special Equipment or Non-Factory Equipment (the term is different with each company). If they are not listed here, they may not be covered in the event of a loss. If you want your car’s bling to be insured, make sure you see it on your declaration page.

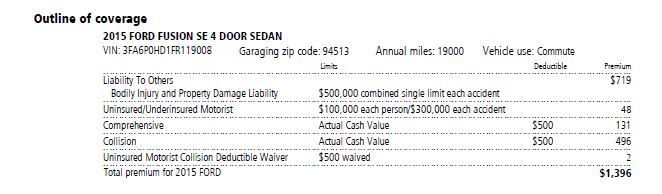

Premium Total

Each vehicle should display a total premium for the policy period. If you have more than one vehicle, these totals will be combined along with any policy fees added for a total policy premium. Additionally, your payment plan and payment amount(s) will be displayed.

Types of Coverage

After speaking in-depth about your needs and how often you drive your vehicle(s), an agent will discuss different types of coverage that apply to different types of losses. Make a wise decision based on how a loss on your car will affect you financially if you’re not fully covered. On your declaration page, each type of coverage you’ve chosen to protect yourself with should be listed separately, along with liability limits and then breakdowns on how much you’re paying for each type of coverage.

Coverage or Liability Limits

For each type of liability coverage you’ve elected to buy, there are coverage limits. What that means is that if you are at fault and damages exceed the coverage limits, you may have to pay the difference out of pocket to meet the costs. You can also set different limits. The higher the limit, the higher the premium you will pay each month. However, if you do have an accident, most if not all of the costs will be covered. For example. If you bought Bodily Injury Liability coverage with $100,000/$300,000 limits, it means that in the case of an accident that was deemed your fault, each person involved in the accident is covered for up to $100,000 worth of medical expenses for a total coverage of $300,000 maximum for the accident.

Deductibles

Even if you buy the most coverage available, you will have to dig into your pockets after an accident before your insurance company pays out. Each type of physical damage coverage you opted for has a different deductible, which is the amount you’re responsible for paying before your insurance kicks in to cover costs. Most deductibles are $500 or $1,000 per car. So, let’s say you bought Collision coverage with a $500 deductible, and the damages amount to $20,000. You have to pay $500 before insurance will cover the rest. On your declaration page, you will see how much you elected to pay for a deductible for each type of coverage. You can always choose to change your deductible amount, but make sure what’s written on your policy is what you are able to pay if you cause an accident.

Discounts

For many of us, discounts are the ticket to a much lower premium on car insurance. You can get discounts for many things including being a mature driver or a good student. If you have post-bachelor degrees, like a master’s or higher, you may also save some money. It’s always good to work with an honest and reliable agent who will truly evaluate your profile to come up with a rate you deserve. All your discounts should be listed on your declaration page.

Endorsements or Riders

An insurance endorsement is used to add, delete or exclude coverage, so it’s a very important section to check on your declaration page. This sort of change to a policy comes in handy if your budget suddenly changes and leaves you no choice but to alter your existing insurance policy. Gap Coverage is a type of endorsement that covers you in the event that the amount you owe on the vehicle is more than the amount you’re covered for after an accident. If you know you’re going out of town and want Rental Car Coverage, you can get an endorsement for that, too. Other common types of insurance endorsements include Roadside Assistance, Towing, and Custom Parts & Equipment Coverage. If you select any of these, make sure you see them on your policy, or else you’re not covered for what you need.

Speak With an Insurance Specialist

Reading a declaration page may be confusing if you don’t fully understand what you’ve bought. If you have a good insurance agent, with the level of customer service that is required to educate clients, you can rest easy. You can always call an Insurance Specialist if you’re confused about the information on your declaration page or if you need to make changes. You may also take this as an opportunity to get several quotes from different carriers. Just visit here or call (888) 772-4247 today. AIS takes the guesswork out of buying insurance.

The information in this article was obtained from various sources. This content is offered for educational purposes only and does not represent contractual agreements, nor is it intended to replace manuals or instructions provided by the manufacturer or the advice of a qualified professional. The definitions, terms, and coverage in a given policy may be different than those suggested here and such policy will be governed by the language contained therein. No warranty or appropriateness for a specific purpose is expressed or implied.