Tuning is a popular hobby for those wanting increased performance from their vehicles. Tiny adjustments can go a long way to increase horsepower and improve the engine’s efficiency. However, your car insurance provider scrutinizes these modifications and will adjust your premiums accordingly. Some changes will increase your monthly payments, while others can save you money. Here’s how vehicle modifications affect car insurance rates.

How Do Vehicle Modifications Impact Car Insurance Rates?

Vehicle alterations are commonplace worldwide, with experts projecting a value of $58.23 billion for the car modification market. The adjustments you make impact performance, security, aesthetics, and other factors for your drive. Modifications can change your insurance rates, but this determination comes from your provider. Insurers differ based on the liability they want to take on.

Most modifications raise your rates — even if they make your car more efficient. Why does this increase happen? Aftermarket devices add costs to your vehicle and make it more expensive to cover, thus making your machine less attractive to the provider. If your car gets into an accident, the insurer will be on the hook for repairing your modified vehicle.

How Do Insurers Cover Vehicle Modifications?

When modifying your vehicle, it’s crucial to understand how each change affects your car insurance rates. Some insurers will include the alteration in your standard insurance, whereas other modifications require special coverage.

Increased coverage may be extra, but ensuring your vehicle has protection is necessary. For example, spoilers to improve engine aerodynamics or backseat TVs for entertainment require additional policies because your car has a higher value. Thus, your vehicle may be more valuable to thieves if they see the add-ons in your vehicle.

What Vehicle Modifications Can Increase Rates?

Most car alterations cause your insurance rates to increase. Here are a few popular vehicle modifications that will typically lead to higher rates.

Turbocharging

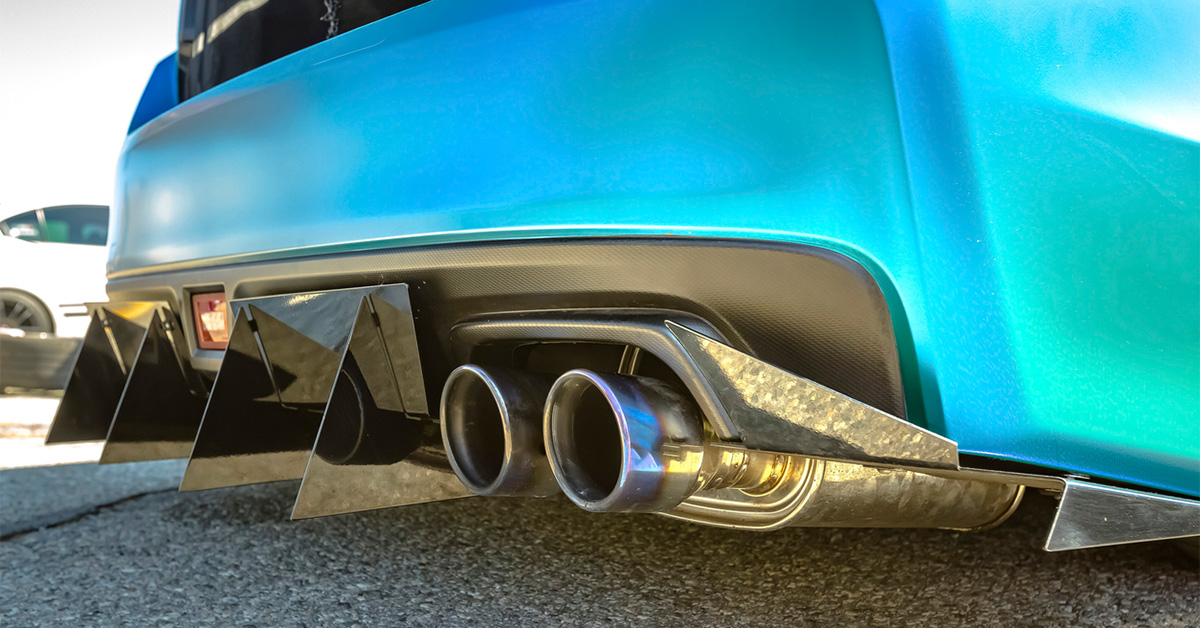

Performance enhancements are among the most common ways to increase car insurance rates. For example, turbocharging and supercharging your engine will likely prompt your insurer to raise your rates or require additional coverage. A turbocharged engine increases power by enhancing airflow, thus maximizing speeds.

These upgrades could come at a cost if you go too far with the modifications. For example, supercharged and turbocharged engines might cause your provider to deny coverage if it thinks your vehicle has become unsafe and too much of a liability to insure. The amount of coverage you get depends on the make and model of your car and the engine upgrades you incorporate.

Roll Cages

Roll cages are an example of modifications that increase safety but can lead to higher car insurance rates. This device protects your vehicle’s infrastructure by reducing the chance of a collapse if you wreck. You and other occupants will be better off with a roll cage, especially if the manufacturer uses carbon-reinforced steel.

Despite the safety advantage, your insurer may see a roll cage as a liability because this device signals that you use your vehicle for off-roading. Roll cages are prominent among off-roaders because they protect vehicles in rough terrain like sand, dirt, and snow. Off-road machines are more expensive to insure, and that will reflect on your rates.

Paint Jobs

The color of your car doesn’t necessarily affect performance or safety, so why does it cause increased rates? Your insurance only covers the vehicle the way it left the dealership when you bought it. Therefore, your rates are susceptible to higher premiums if you make minor alterations, such as a paint job.

Custom paint jobs will likely increase your rates because they’re more expensive to repair once damaged. For example, the paint may rust if you live in a humid coastal area due to the increased salt and moisture in the air.

What Vehicle Modifications Can Decrease Rates?

While many vehicle modifications increase rates, some alterations can decrease your car insurance payments. Here are some ways you can reduce rates, depending on your insurer.

Driver Assistance

Safety systems are a common way drivers reduce their liability, and advanced driver assistance systems (ADAS) are a modern innovation that can prompt lower rates. While new to the industry, ADAS and autonomous driving (AD) will grow to a market value of $120.7 billion by 2027 because of how many automakers incorporate them into vehicles. ADAS lets you easily detect pedestrians and correct your car within a highway lane.

Anti-Theft Systems

Automobile theft is less in a driver’s control, but it still matters in the eyes of car insurance companies. Research shows the motor vehicle theft rate steadily declined from 1990 until the mid-2010s but has risen in the last few years. The U.S. sees about 282.7 cases per 100,000 people, emphasizing the need for anti-theft systems. Some insurers provide rates for installing steering wheel locks, car alarms and vehicle tracking systems.

Adaptive Headlights

Adaptive headlights are another minor modification to lower your insurance rates. This technology adjusts to your steering wheel’s movements and provides better lighting on dark roads. Adaptive headlights move with your car instead of relying on a fixed position, thus maximizing your vision when turning. Your insurance provider may discount your rate if they approve the modification.

Examining the Impact of Modifications

Vehicle modifications are common ways to increase a vehicle’s performance and enhance safety. While some alterations are for aesthetics, others are necessary for increased speed and efficiency. Nonetheless, it is essential to examine how these additions affect your insurance rates. Report any alterations and custom parts to your provider to ensure coverage in case of an accident.

Author Bio

Jack Shaw, the senior Cars editor of Modded, is an accomplished automotive writer with a flair for adventure and a passion for vehicular innovation. Having written for notable sites such as the National Motorists Association, Ford Muscle, Offroad Xtreme, and more, his articles are a testament to his knowledge and love for the automotive industry.

The information in this article is obtained from various sources and offered for educational purposes only. Furthermore, it should not replace the advice of a qualified professional. The definitions, terms, and coverage in a given policy may be different than those suggested here. No warranty or appropriateness for a specific purpose is expressed or implied. The opinions expressed by guest bloggers are theirs alone and do not reflect the opinions of AIS Management LLC, any subsidiary or affiliate of the same, or any employee thereof. We are not responsible for the accuracy of any of the information supplied by the guest bloggers.