Parents are usually concerned about their children’s performance in school because they want them to have bright and exciting futures. But here’s a way your child’s academic commitment can pay off now: With AIS, your child may be eligible for a good student discount that could save you up to 30%, depending on your policy.

Why do we offer a discount like this? To understand this, we first need to know why teenagers typically have such high insurance rates in the first place. Insurance is all about mitigating or reducing risk, and, well, teenagers usually represent a higher risk to the insurance company.

Why Are Teens Considered High-Risk?

Teenagers and young adults are subject to high insurance rates for several reasons, not all of which are under your control. One of the biggest problems is simply that teenagers haven’t had much practice driving. The more experience a driver has, the safer they’re likely to be. According to the CDC, the risk of an auto accident occurring is higher among teens aged 16-19 than any other age group. In fact, a 2019 report determined the presence of a teen passenger increases the crash risk of unsupervised teen drivers. With each additional teen passenger, the risk increases.

There are a few more additional factors that can put teens at risk. See the risk factors below and make sure you and your young driver are aware of these leading causes of teen crashes and injuries:

- Nighttime and Weekend Driving

- Not Using Seat Belts

- Distracted Driving / Cellphone Use

- Drowsy Driving

- Speeding

- Alcohol Use

Why Good Grades Help

If you’re the parent of a young driver, you may know the pain of paying your insurance bill once your teen driver is added to your policy. The good news is if your child gets good grades, you may be able to reduce your car insurance premium. Most insurance companies view having good grades as a reflection of how responsible and attentive a teenager is.

Suppose students can listen and absorb information in class, bring their assignments in on time, and do them well enough to lead the class. In that case, it indicates maturity, responsibility, and forethought, in which they’re rewarded with a discount by most insurance companies. Additionally, teenage drivers who possess these qualities are less likely to get into accidents as they are unlikely to partake in risky behaviors, like speeding or drag-racing. So, the next time you talk to your child about grades, remind your teen that performing well in school affects their future and saves you money in the long run.

How To Qualify For the Good Student Discount

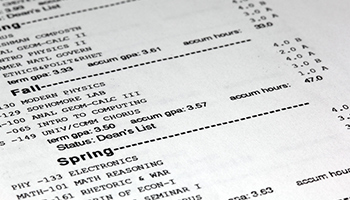

With most insurance companies, proof of good student eligibility is required before the discount can be applied. It’s important to note that insurance companies’ qualification rules for a good student discount vary, so check with your insurance provider before submitting proof. Generally, to qualify for the good student discount, your student needs at least a B average overall and must be enrolled full-time in high school or at an accredited college. Transcripts and/or report cards are usually accepted by most insurance companies as proof. Insurance companies may also include an age limit of 25 years old to qualify for the good student discount.

Check With AIS Insurance To See If You Qualify

Want to know if you or your child can qualify for the good student discount? Speak with a licensed Insurance Specialist today at (855) 919-4247 and we’ll go over the requirements together. Discounts are not the only way you can save on your auto insurance. The best way to find the cheapest rates is to compare auto insurance quotes among several insurance providers. Get a free online quote today and see how much you can save with AIS Insurance.

The information in this article is obtained from various sources and offered for educational purposes only. Furthermore, it should not replace the advice of a qualified professional. The definitions, terms, and coverage in a given policy may be different than those suggested here. No warranty or appropriateness for a specific purpose is expressed or implied.