Motorcycles are often stolen due to a lack of anti-theft devices. Even though remote starting devices have been banned in California and are used less often, there is still a high rate of theft. Here is some information on motorcycle theft statistics, how theft can be prevented, and how to make the most of your motorcycle insurance coverage.

Motorcycle Theft on the Rise

According to the most recent report from the National Insurance Crime Bureau (NICB), more than 45,500 motorcycles were reported stolen in 2015, an increase of 6% over the prior year. The top state for motorcycle thefts? California, with 7,221 thefts, followed by Florida (4,758) and then Texas (3,403).

If you thought that Harleys are the most stolen ride, you’re wrong. In fact, Hondas are the most stolen motorcycle, accounting for 1 out of every 5 motorcycles stolen. These are followed up by Yamahas, Suzukis, Kawasakis, and then Harley-Davidson motorcycles.

Avoiding the Theft of Your Motorcycle

Motorcycles have a special allure for thieves because they’re easier to steal than cars. Many motorcycles are also easy to strip for parts or sell whole at a quick profit, making them a valuable choice. Only about 39 percent of stolen motorcycles are ever recovered, so your best strategy as a motorcycle owner is prevention.

Here are several things you can do to protect your motorcycle from theft:

- Use your ignition lock. (It’s not enough just to have the machine turned “off.”)

- Lock your ride to a stationary object.

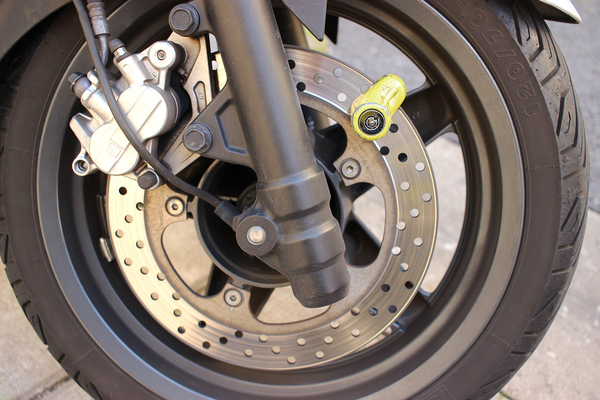

- Lock the disc brakes and forks.

- Park your motorcycle with other bikes.

- Install a motorcycle alarm, and use it.

- Install a hidden “kill” switch.

Safety measures and motorcycle insurance can protect you from motorcycle theft.

Motorcycle Insurance and Potential Discounts

All states, including California, require minimum amounts of insurance on a motorcycle. You’re required to have motorcycle insurance that protects others in case you are in an accident and cause injury or property damage. What this minimum coverage doesn’t provide, however, is damage or loss to your motorcycle, even if it’s stolen. You’ll need comprehensive motorcycle insurance coverage to recoup any of your loss.

Some motorcycles today are worth upwards of $20,000. If you had to replace that sort of machine after a theft, it would likely be a financial hardship. A comprehensive motorcycle insurance policy can protect you from the financial loss associated with motorcycle theft while providing other benefits.

You can even get what’s called total loss coverage, which will pay to buy you a new motorcycle (current model year) in the event that your ride is totaled. If you don’t have this coverage and your motorcycle is totaled or stolen, you will receive the actual cash value, or current day worth, of the vehicle.

When you shop for motorcycle insurance, be sure to ask about discounts for your theft prevention measures. You may be able to qualify for premium discounts for such things as alarms, safety locks, and lo-jacks. Get a motorcycle insurance quote to protect your investment from damage and theft.

The information in this article was obtained from various sources. This content is offered for educational purposes only and does not represent contractual agreements, nor is it intended to replace manuals or instructions provided by the manufacturer or the advice of a qualified professional. The definitions, terms and coverage in a given policy may be different than those suggested here and such policy will be governed by the language contained therein. No warranty or appropriateness for a specific purpose is expressed or implied.